Medicare Supplemental Insurance

When you are new to Medicare, you may be surprised that Part B has a 20% out of pocket expense for care without Maximum Out of Pocket Caps. This could be financially devastating if you become seriously ill or injured. These plans, also known as Medi-Gap coverage, pay your share of Medicare expenses.

Medicare Supplemental Plans are offered by private health insurance companies. These plans are standardized across the different companies. The main difference is the premium you will pay.

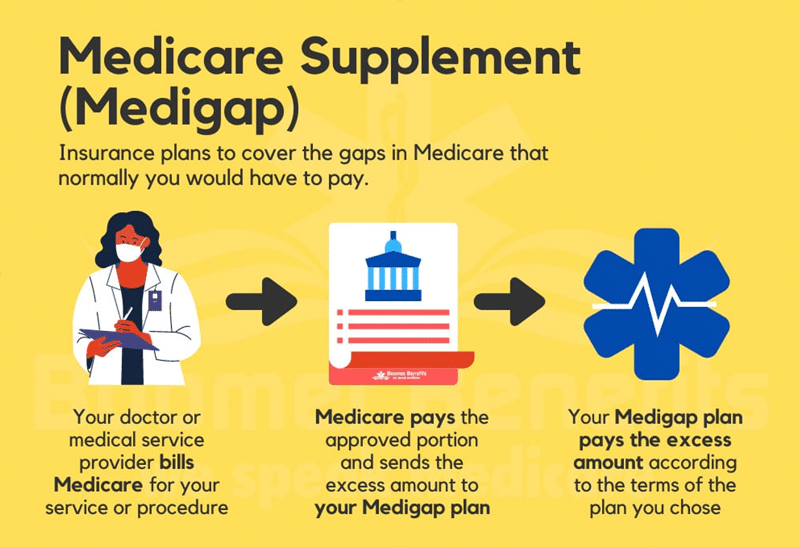

What is Medicare Supplemental Insurance and How Does it Work?

You must maintain Medicare Parts A and B as it is your primary coverage.

- Medicare Part A hospitalization coverage has a deductible you have to pay upon admission. This is due every 60 days if readmitted.

- Medicare Part B medical coverage has a deductible. After paying the deductible you have a 20% out of pocket expense with no out of pocket max in payments.

Medicare Supplemental Plans cover these “gaps”. The amount of coverage varies by plan. Medicare Supplement is accepted everywhere Original Medicare is accepted.

- These plans act as a secondary payor with Original Medicare being the primary payor of your medical cost.

- Prescription drug coverage is not included. You will need to purchase a Part D prescription plan.

- Typically does not cover routine dental, vision, and hearing services. There are plans available to buy up for these services.

- There are 10 plans available to choose from.

- You are guaranteed enrollment during your Initial Enrollment Period and can change plans annually during your birthday month without medical underwriting.

- There are no networks or referrals. You’ll have the freedom to see any provider that accepts Medicare.

What Are The Different Medicare Supplement Plans?

Each of the 10 Medicare Supplement Plans is represented by the letters A through N. Each letter represents a different coverage. Some plans are more popular than others. Below is a chart to summarize the coverage for the different plans.

| Medicare Supplement Benefits | Medicare Plans |

|||||||||

| A | B | C | D | F* | G | K | L | M | N | |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes*** |

| Blood (first 3 pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled nursing facility care coinsurance | No | No | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A deductible | No | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Part B deductible | No | No | Yes | No | Yes | No | No | No | No | No |

| Part B excess charge | No | No | No | No | Yes | Yes | No | No | No | No |

| Foreign travel exchange (up to plan limits) | No | No | 80% | 80% | 80% | 80% | No | No | 80% | 80% |

| Out-of-pocket limit ** | N/A | N/A | N/A | N/A | N/A | N/A | $5,560 | $$2,780 | N/A | N/A |

* Plan F also offers a high-deductible plan. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,300 before your Medigap plan pays anything.

** After you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

Starting January 1, 2020, Medigap plans sold to new people with Medicare won’t be allowed to cover the Part B deductible. Because of this, Plans C and F will no longer be available to people new to Medicare starting on January 1, 2020. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

Office

2725 E Pacific Coast Hwy.

Suite #101

Signal Hill, CA 90755